nanny tax calculator uk 2020

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Nannytax Interviews Nanny Of The Year 2020 Nannytax

The Nanny Tax Company has moved.

. Transfer unused allowance to your spouse. Cost Calculator for Nanny Employers. Calculation is for April 2022 to.

For an exact calculation based on salary actual tax code and employment status telephone our help desk Mon Fri 0930 am 500 pm 020 8642 5470 or e-mail us at. The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations. This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again.

Our nanny payroll service is paid for by your employer but you also get access to our experts at no charge to you. For an exact calculation based on salary actual tax code and employment status telephone our help desk. Your individual results may vary and your results should not be viewed as a.

Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. Our new address is 110R South. Income Tax Calculator is the only UK tax calculator that is EASY to use FREE.

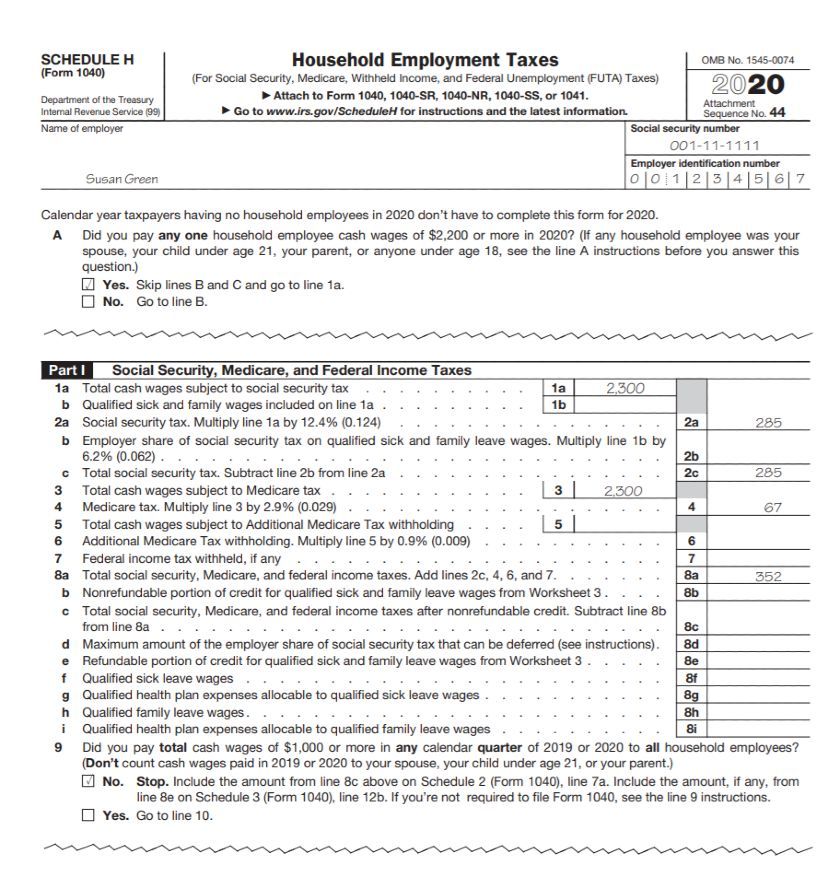

Calculate your salary take home pay net wage after tax PAYE. Here is the IRS publication. This calculator assumes that you pay the nanny for the full year.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. NannyMatters have provided professional nanny payroll services and expert tax advice for parents since 2002. Free tax code calculator.

For a competitively priced annual fee we remove all the worry that can. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not. For tax year 2021 the taxes you file in 2022.

11 income tax and related need-to-knows. We go the extra mile to make sure you are properly looked after. Ensure that the employee has the right to work in the UK.

Select the tax code to use or specify other eg for a nanny share or more than one job calculations I confirm the calculation parameters as shown. The complete candidate document package will be submitted to you following the placement. Tax calculators and tax tools to check your income and salary after deductions such as UK tax national insurance pensions and student loans.

This is a sample calculation based on tax rates for common pay ranges and allowances. Salary Workplace Pension Calculator 2018-19 Tax Year Enter Salary. Check your tax code - you may be owed 1000s.

Updated for the 2022-2023 tax. Nannytax is the UKs nanny payroll market leader. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior care worker or other household.

This tells you your take-home. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. This calculator assumes that you pay the nanny for the full year.

This tells you your take-home. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny. The latest budget information from April 2022 is used to.

The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two. Nanny tax calculator uk 2020. Negotiate a gross salary with your.

For an exact calculation based on salary actual tax. See where that hard-earned money goes - with UK income tax National Insurance student. Calculate your salary take home pay net wage after tax PAYE.

Nanny tax calculator uk 2020. Written by Luke Harman.

Monthly Payroll Weekly Pay Vs Biweekly Bimonthly Pay Weekly Pay Vs Monthly

What Are Employer Taxes And Employee Taxes Gusto

When Are Federal Payroll Taxes Due Deadlines Form Types More

Your Us Expat Tax Return And The Child Care Credit When Abroad

Provision For Income Tax Definition Formula Calculation Examples

Self Employment Tax Tax Guide 1040 Com File Your Taxes Online

What Are Employer Taxes And Employee Taxes Gusto

Here S Why Actually The Irs 600 Bank Reporting Proposal Is Entirely Reasonable

Marketplace Facilitator Laws Explained Taxjar

Corporate Tax Meaning Calculation Examples Planning

The Top 15 Payroll Forms You Need When Running A Company In Usa

How To Do Payroll Yourself For Your Small Business Gusto

Your Us Expat Tax Return And The Child Care Credit When Abroad

2016 Instructions For Schedule H Form 1040 Household Employment Taxes 2016 Instruction Internal Revenue Service Schedule

Can I Deduct Nanny Expenses On My Tax Return Taxhub